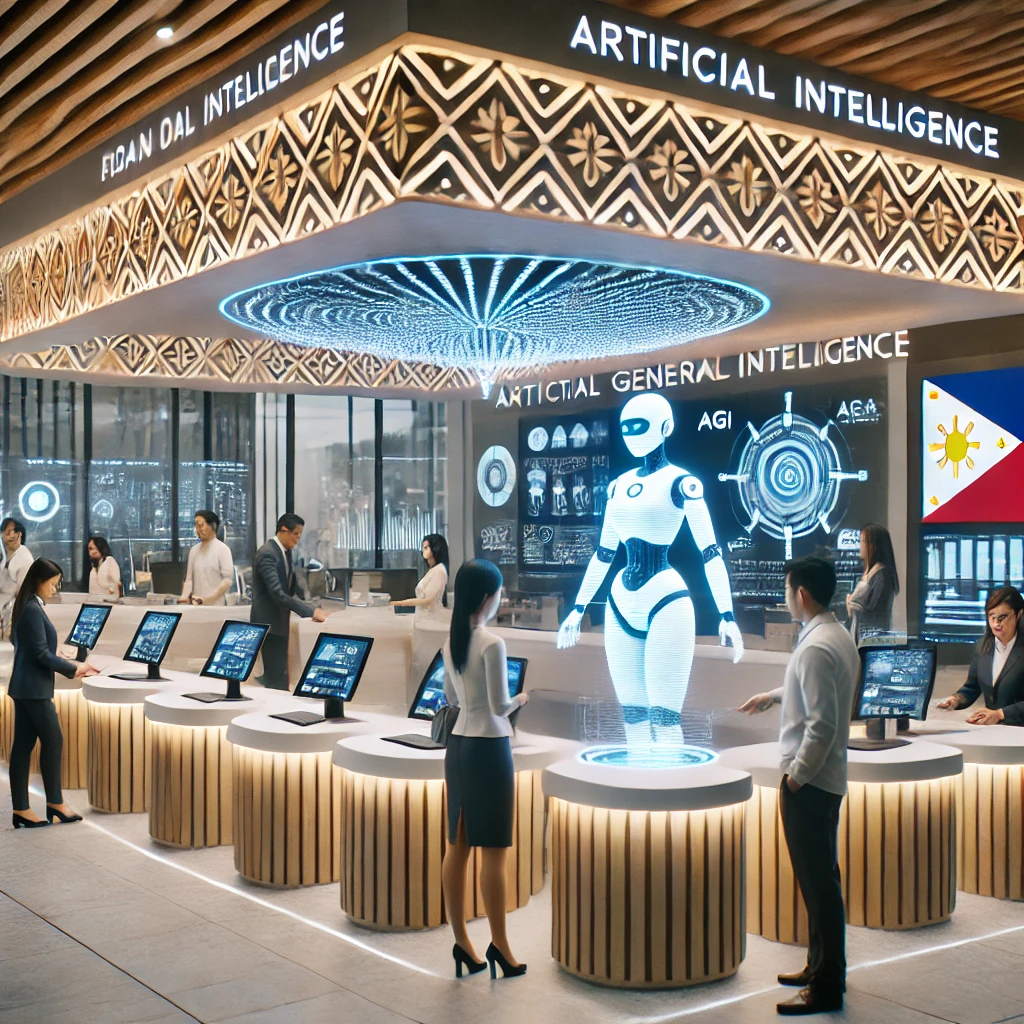

Artificial General Intelligence (AGI), an advanced form of artificial intelligence capable of performing any intellectual task that a human can do, holds immense potential for revolutionizing industries. For banks in the Philippines, the integration of AGI into their operations offers a transformative opportunity to enhance efficiency, improve customer experience, and drive profitability. Here’s how AGI can empower Filipino banks to stay competitive in the rapidly evolving financial landscape:

1. Hyper-Personalized Financial Services

AGI can analyze vast datasets, including customer behavior, transaction history, and social patterns, to offer hyper-personalized financial products and services. For example:

- Customized Loan Offers: AGI can tailor loan terms and interest rates to individual customers based on their financial health and risk profile.

- Financial Advisory: Providing personalized investment strategies and savings plans, even for customers in rural areas with limited access to traditional banking services.

Profitability Impact: Increased customer satisfaction and loyalty lead to higher retention rates and cross-selling opportunities.

2. Enhanced Fraud Detection and Risk Management

Fraud is a significant challenge for banks. AGI’s advanced pattern recognition capabilities can identify suspicious transactions in real-time, even those that traditional systems might miss. Additionally:

- Risk Prediction: AGI can assess credit risks with unprecedented accuracy by analyzing unconventional data sources, such as market trends and geopolitical factors.

- Adaptive Security: AGI can continuously learn and adapt to emerging threats, reducing the impact of cyberattacks.

Profitability Impact: Lower fraud losses and better risk-adjusted returns on loans and investments.

3. Operational Efficiency Through Automation

AGI can streamline and automate back-office operations, drastically reducing costs and improving efficiency:

- Document Processing: Automating loan approvals, account opening, and compliance checks.

- Customer Support: Providing instant resolutions to customer queries via AGI-powered virtual assistants that understand and respond like human agents.

Profitability Impact: Reduced overhead costs and faster service delivery enhance the bank’s bottom line.

4. Expanding Financial Inclusion

In the Philippines, a significant portion of the population remains unbanked or underbanked. AGI can help bridge this gap by:

- Intelligent Outreach: Identifying underserved populations and creating tailored products, such as microloans or low-cost savings accounts.

- Multi-Language Support: Offering services in regional languages, breaking down linguistic barriers.

Profitability Impact: Capturing untapped markets increases the bank’s customer base and deposit inflow.

5. Real-Time Analytics for Strategic Decisions

AGI enables real-time data analysis, giving banks the agility to respond to market changes and customer needs quickly:

- Dynamic Pricing: Adjusting interest rates and fees based on market trends and customer behavior.

- Market Insights: Identifying new opportunities, such as emerging industries or underserved sectors.

Profitability Impact: Improved decision-making enhances revenue streams and ensures long-term growth.

6. Sustainable Banking Practices

AGI can help Filipino banks align with Environmental, Social, and Governance (ESG) goals:

- Green Finance: Identifying projects eligible for green loans and ensuring compliance with sustainability standards.

- Impact Assessment: Monitoring the social and environmental impact of investments.

Profitability Impact: Attracting socially conscious investors and meeting regulatory requirements while contributing to national development.

Challenges and Considerations

While AGI offers immense potential, Filipino banks must address challenges to unlock its full benefits:

- Infrastructure Readiness: Investing in robust IT infrastructure to support AGI systems.

- Regulatory Compliance: Navigating data privacy laws and ensuring AGI operates within legal frameworks.

- Ethical Use: Ensuring transparency and fairness in AGI decision-making to maintain customer trust.

Conclusion

For banks in the Philippines, AGI represents not just a technological upgrade but a strategic enabler of growth. By leveraging AGI to deliver personalized services, enhance security, and reach underserved communities, Filipino banks can significantly boost profitability while fostering financial inclusion and innovation. The early adopters of AGI will undoubtedly position themselves as leaders in the country’s financial sector, reaping the rewards of this transformative technology.

[SEO optimized]